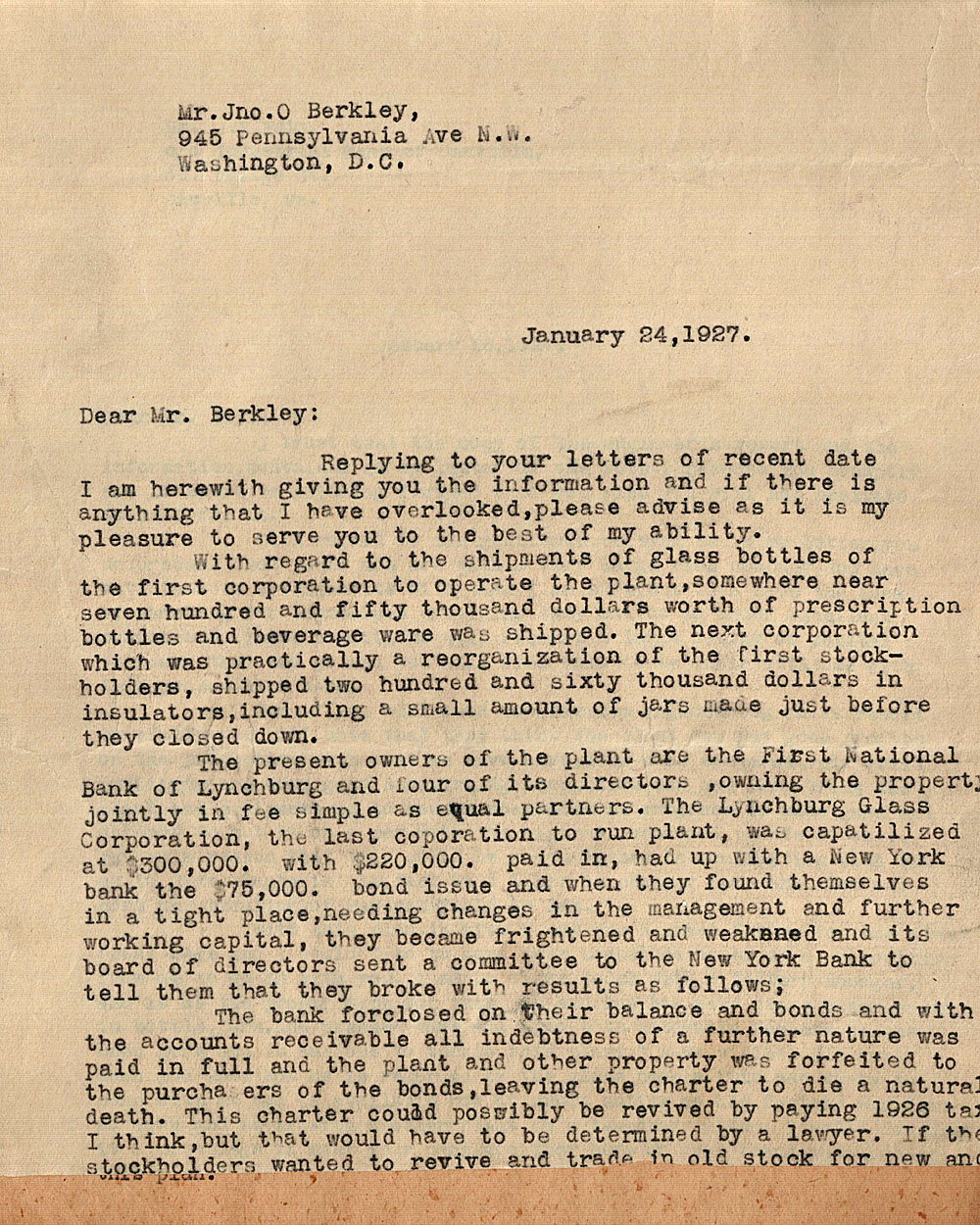

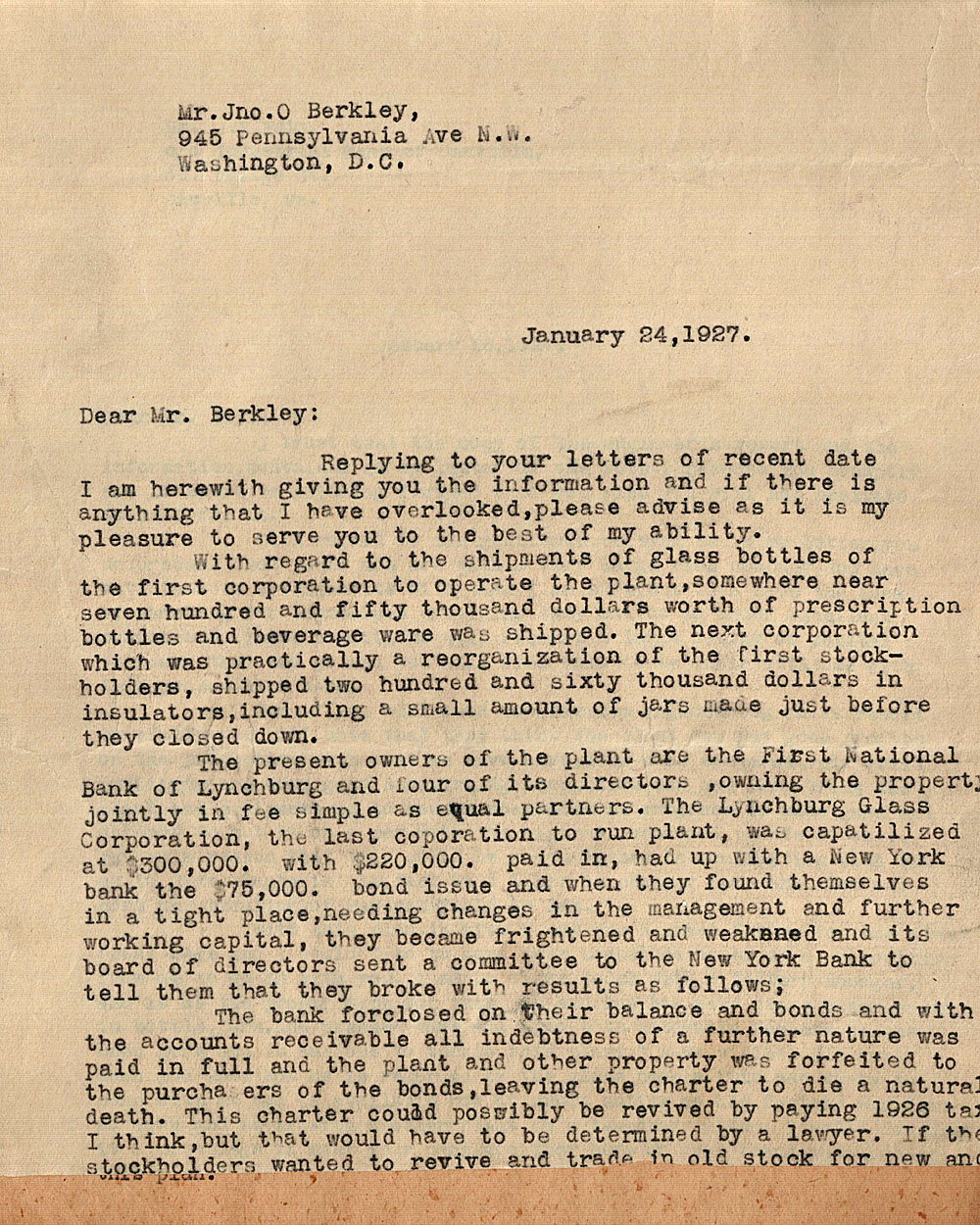

Lynchburg Letter: W. H. Loyd to Jonathan Berkley

January 24, 1927

Responding to an inquiry, Mr. Loyd gives a brief synopsis of the sales history of the two Lynchburg companies, including attempts to refinance the second company. Original document was scanned by Dennis Bratcher and converted to text. A scan of W. H. Loyd's copy of the original letter is below. The letter is incomplete; the second page is missing.

Mr.Jno.O Berkley

945 Pennsylvania Ave N.W.

Washington, D.C.

January 24, 1927.

Dear Mr. Berkley:

Replying to your letter of recent date I am herewith giving you the information and if there is anything that I have overlooked, please advise as it is my pleasure to serve you to the best of my ability.

With regard to the shipments of glass bottles of the first corporation to operate the plant, somewhere near seven hundred and fifty thousand dollars worth of prescription bottles and beverage ware was shipped. The next corporation which was practically a reorganization of the first stockholders, shipped two hundred and sixty thousand dollars in insulators, including a small amount of jars made just before they closed down.

The present owners of the plant are the First National Bank of Lynchburg and four of its directors ,owning the property jointly in fee simple as equal partners. The Lynchburg Glass Corporation, the last corporation to run the plant, was capitalized at $300,000. with $220,000. paid in, had up with a New York bank the $75,000. bond issue and when they found themselves in a tight place,needing changes in the management and further working capital, they became frightened and weakened and its board of directors sent a committee to the New York Bank to tell them that they [were] broke with results as follows;

The bank foreclosed on their balance and bonds and with the accounts receivable all indebtness [sic] of a further nature was paid in full and the plant and other property was forfeited to the purchasers of the bonds, leaving the charter to die a natural death. This charter could possibly be revived by paying 1926 taxes I think, but that would have to be determined by a lawyer. If the stockholders wanted to revive and trade in old stock for new and

[The second page of the letter is missing]

|